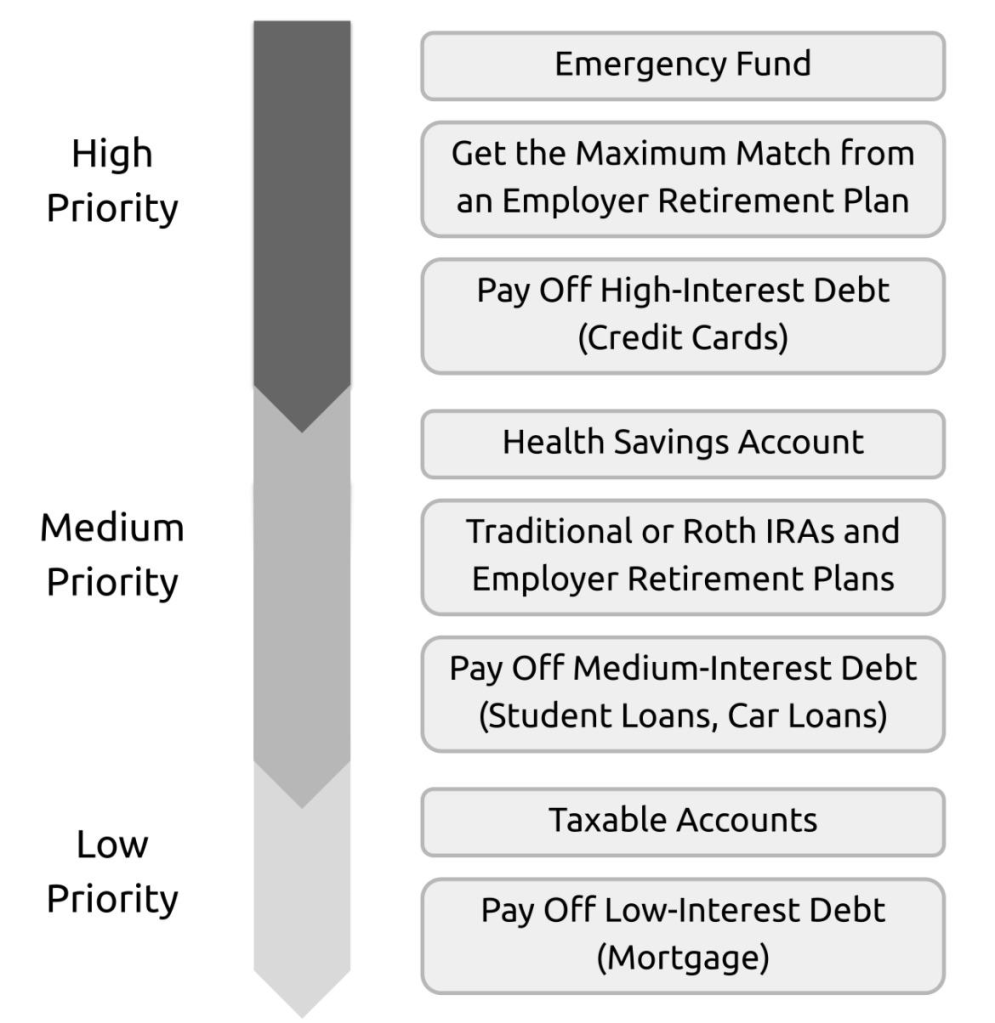

I found the above graphic in the wild and thought it was a fairly good prioritization of money priorites.

However, I would base the debt on interest rates but most people probably don’t know what their interest rates are on their debt. I really like the FOO by the Money Guys. However, they have caveats on it based on your risk tolerance, risk capacity, and how old you are. Personal finance is personal and nuanced.

There are competing priorities which can be based on a number of factors and winning with money doesn’t mean dieing with the most. I would argue at a certain point you should make less optimal money choices if it removes risk from the table. For example, if you have enough money to glide into a more than comfortable retirement then I would start paying off low interest debt like a mortgage so you never have to worry about not having a home.

I listened to a podcast with the author of “Die with Nothing.” He makes a similar argument and reminds the listener that at an earlier age than you think there will be a last time you can accomplish some tasks like skiiing, wakeboarding, flying, or traveling by living in hostels. Do those when you can so you have those memories in your old age and not regrets.

Leave a comment