A few weeks ago I received a tentative offer for a VA position as a librarian. I accepted. The position is a promotion, in the heart of Appalachia, and non-supervisory. Each of those things are important but interpersonnel relations in my current organization have reached a boil and its time for me to go elsewhere. I told my Flight Chief that despite the issues I am proud I was able to keep everyone working together as long as I did. Hopefully new blood in my position will be what the organization needs.

Focusing on the future. We will be closer to home in GA. The area in WV looks gorgeous. The capital of Morgantown will be about an hour away. As Lauren mentioned we are currently not just rural but isolated and remote. The first weekend we are there we just bought tickets to a local festival and will be seeing, appropriately, Tyler Childers. I feel like I am reconnecting with the strongest modern voice representing my Appalachian ancestors.

A couple of weeks ago after viewing several poor quality houses we are under contract for a new house. As I have mentioned a few times already; we are fortunate to not have to have our purchase contingent on the current sale of our Oklahoma home.

A small town to the north, Fayette, looks like a great area to get some good food and talk to interesting people. Lewiston or something similar looks like a great resort town to the east. Our little neighborhood looks like a safe neighborhood and is conveniantly located near the VA hospital. I purchased a commuting bicycle with goals of commuting normally to work.

One area deserving attention is that Lauren does not currently have a job there. However, she has put in a dozen plus applications and has an interview with Kanawha Public Library which looks about 50 minutes away. They are flying her out which is a good sign she is near the top of their list.

Overall, we had 4 great opportunities for positions in the last few months. Aviano, Mildenhall, Fort Leonard Wood, and Beckley VA. We created a numerical assessment of each opportunity and Beckley came in first. Though exciting, the overseas positions would have been beyond stressful with the three dogs for both us and them.

Career wise since I have really increased my applications for quarterly awards almost a year ago I have won two Airmen of the Quarter Award and an Airman of the Year Award. Maj Lockett has been a huge supporter of me and I appreciate her.

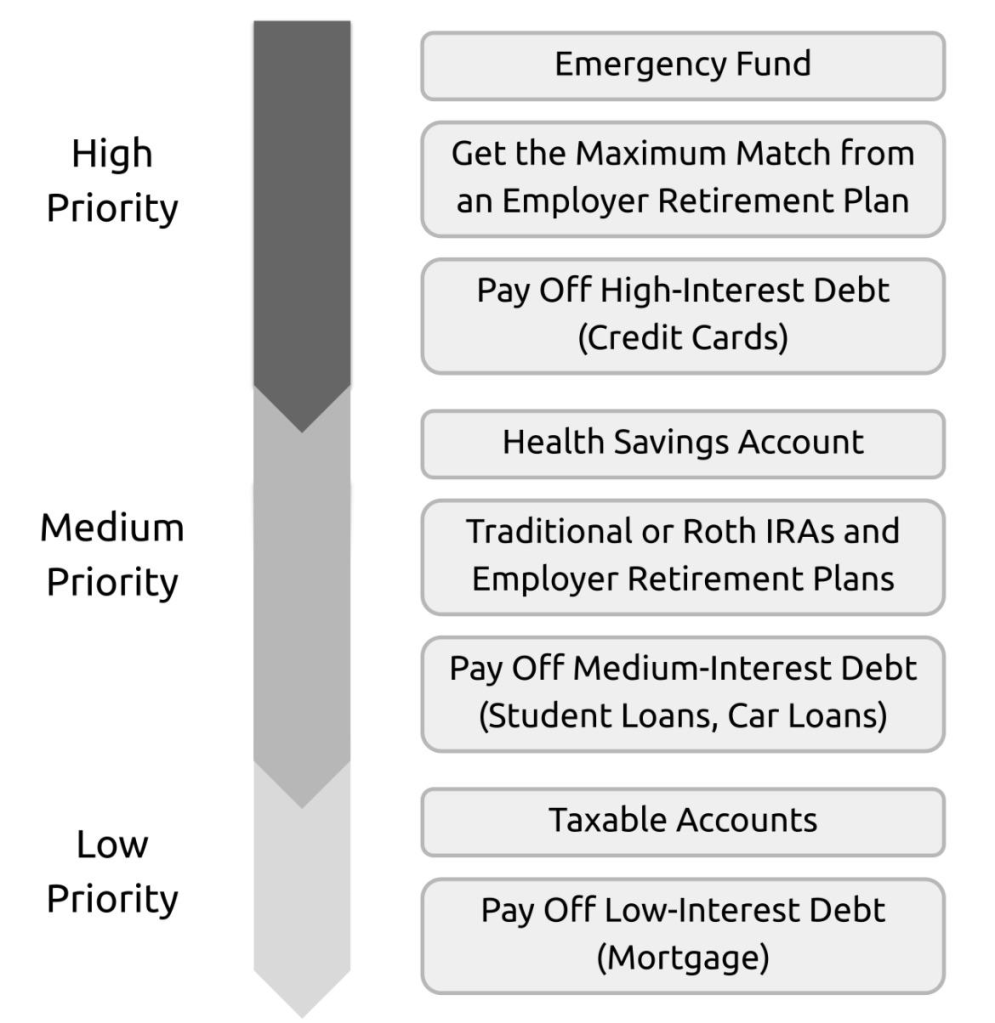

However this is primarily a finance related blog but it may be more leaning towards a journal due to Tal’s recommendation. Our future finances will be tighter and the current projection is to pay off the mortgage faster due to an above 6% interest rate. 6% has historically been a high guaranteed rate of return and since debts work similar to investments then it makes sense to focus on a guaranteed high return. However houses are a leveraged asset and when paying them off you are deleveraging risk and adding principle. We could also refinance in the future. Investing in the higher paying stock market would probably have us ending in a higher net worth. Do we want to deleverage and remove risk from the equation or invest in stocks for the probably higher return? Fortunately we have a large snowball of assets rolling in the background to keep us on track for retirement and I believe in this new area we can expand out some lifestyle in more life enhancing ways.

Altus has been great for building assets for our family. The market has taken a couple of notable tumbles since 2020. Due to federal employment, I was consistently able to throw money into the market without fear of losing my position and we bought a share of these companies at discount prices . This is a true strength of federal employment. A previous coworker, Hwal Yi, was a great example of how low paying stable employment can be more important than high paying but unstable employment.